Hello there, welcome to WeeklyBagel personal finance blog and podcast!

WeeklyBagel is a personal finance brand dedicated to simplifying personal finance for young adults in the workforce and college. It is for newly independent adults, college students and any adult struggling to save amidst rising costs of living and monthly expenses.

According to National Endowment For Financial Education, young working class adults who receive financial education are less likely to max out their credit cards, spend more than $1000 on credits or be financially irresponsible. The study shows any financial education at this age will be crucial in your life later.

This is because it increases your likelihood of saving money, paying off credit card debt or loans, investing wisely or making bill payments on time.

Given financial classes are not mandatory for young working class adults in college or jobs, WeeklyBagel’s mission is to help simplify personal finances so you can make good financial decisions. This is with regards to your hard-earned money.

What You Will Get Out Of WeeklyBagel

Just kidding.

It is a start though. A study by the MikenLife Institute, found the absence of personal finance knowledge and skills can severely impede the financial growth and prosperity of the young working class in America. This is a persistent problem across racial, gender and economic lines in the United States. It is an issue, which is severely neglected in most states’ educational boards.

The same MikenLife Institute study, found working class adults lacking financial literacy, spends 12 hours weekly dealing with their financial issues. Also, they work 6 hours compared to the 3 hours worked by their peers who are financially literate.

Now, every young working class adult understands life struggles comes with the territory. However, a poor understanding of personal finance does not need to cause such frightening, excruciating or catastrophic results. Am I right?

This is why the knowledge, skills, attitude and behaviors of financial literacy need to be taken seriously, if we ever want to successfully create our ideal success.

Through WeeklyBagel, you are going to learn how to manage your debts, minimize expenses and save money. As part of this blog’s mission, I am going to simplify banking basics, so you will know how to communicate your needs to your bank on your next visit.

This was very hard for me as a young working class adult in his early twenties. As a newly independent young American with a heavy accent and little banking knowledge, the staff at my bank never took me seriously. It was upsetting, because my financial needs were not understood or met by my bank then.

At least, until I understood the basics of banking.

Whether the big break comes or not in your life, I want WeeklyBagel to lay the personal finance foundation for you. It will help you avoid crippling debts, money mismanagement and financial embarrassment after you start making a good income monthly.

This is what I want for you.

My goal here is to equip you with the necessary financial skills you need to manage your money. Above all, I want to help you succeed. Sounds like a deal, my good reader?

What You Need To Know About Me?

I am Chimezie. Everyone calls me Chime (Chi-meh), because my first name gets butchered a lot whenever people attempt to say it. You tried to pronounce my first name now, didn’t you?

Hahaha… Do call me Chime please, my good reader.

I am an American immigrant, who figured I could go to college and graduate twice without student debt. Or, saved money while working as a janitor in my second year in the United States and college, to build a family house so I do not have to wire money home regularly to my aging parents for rent and expenses.

Who I am

- I am Chime (Chi-meh).

- A small-time financial Investor.

- Founder of WeeklyBagel.

- A certified surgical technologist.

- I like Muay Thai, Heavy Weight Lifting and Fishing.

Fun Facts

- Moved to the United States alone at the age of 22.

- Built my parents a 3 bedroom house, while in college.

- Taught myself to swim in a leech-infested African river.

- Graduate college debt-free twice.

What I hope to accomplish

- Simplify personal finance for you

- Help you get out of debt- college or credit card.

- show you ways to budget and save money.

- Teach you banking basics to help you make good financial decisions.

- Talk about ways to set yourself up for financial success.

And, the part where I built my parents a house in my second year in the United States as a college student working as a janitor?

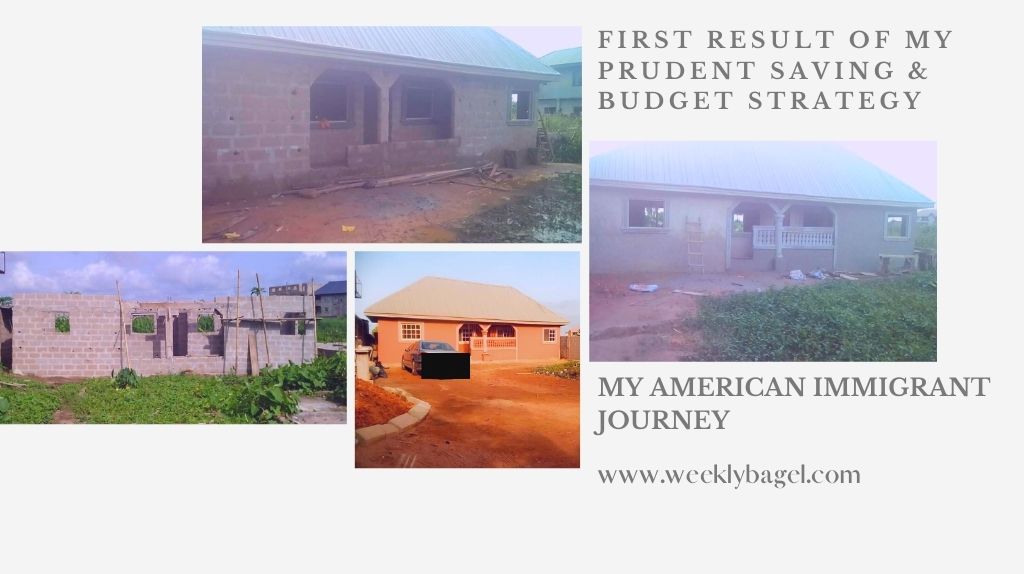

Here is a picture of the house in my native city. It was completed in Spring 2016- a year before I graduated with my first degree from San Antonio College. This house is a result of a prudent budget and two years savings!

Since then, let us say I have gotten another degree and graduated debt free again. Also, I have acquired and grown a few number of successful investments.

All it took to make these a reality is an understanding of personal finance, especially a conservative approach to saving, budgeting and debt avoidance. Prior to these little successes of mine, I had committed severe financial blunders which nearly wiped me out.

There is nothing magical about money management. It is a little bit of arithmetics, a basic understanding of personal finances and some plans. With a basic understanding of personal finance, you too can carve out the kind of life you want regardless of what your current job is.

Or even better, afford almost anything you want with time.

At your age right now, adulting is probably hard. Especially, when your income is going into bills and expenses. I have been there before. I know how it feels. It is the price of being an independent adult.

And, this is why I am here to help you learn all you need to make good financial decision for your postsecondary education or job.

Well, I am available to answer questions pertaining to personal finance. Feel free and email me at [email protected]. With that said, here is to our journey as adults who are masters of their fate and captain of their souls!

Sincerely,

Chime N.U (Weeklybagel Blog Founder)