Check writing is a skill every adult should acquire. Not only because it is cool, but also it is a necessary aspect of living. As an adult with living expenses, you are going to have your fair share of writing a check. So, I have simplified the process for you.

This way, you will decrease your chances of your check bouncing. Or, even worse a check fraud since it can get you penalized by your bank. With that said, let us analyze the anatomy of a typical check.

What Is the Anatomy Of A Check?

Different banks have check books. The designs on them may be different, but they all have the similar parts of a check. Here are the features of a typical check issued by an American bank.

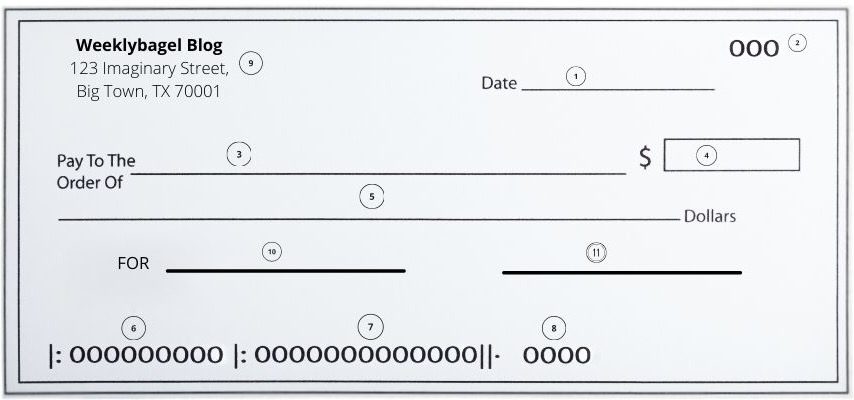

A Sample Check: Design by/with Canva

- Date: This is where you put the date on which your check is written. It must be the date of writing, no future or past dates.

- This is the check number. If you got a check book from your bank, your check book probably has a number of individual checks. Each single check in a check book has a unique number.

- This space is for the payee. If it is an individual, use their first and last name. If it is a business, use business name or associated identification.

- You write the amount to be cashed by the payee here. The amount should be filled in numbers. I am going to show you how later.

- This is where you write the legal amount in words.

- Whenever you see a 9-digit number encased in a colon and line on a check, it is your routing number. Usually, bank routing numbers are a 9-digit number in the United States.

- This is your account number. If you are bad at memorizing account numbers like me, you can look it up from checks.

- This is your check number. Also, it is the same as number two.

- It should bear your printed name, since it is your check. Your bank probably already printed your name on it, since you are using its check book.

- You can put why you are making out the check to the payee. However, this is optional.

- This is where you put your signature. Your check must bear your signature, otherwise it cannot be cashed.

Commonly, these are the features of most checks. Be familiar with these parts of a check. All checks should have an anatomy similar to this or exactly the same. If it is not similar to the one here, you can always call your bank to explain your check book to you.

What Is the Correct Way To Write A Check?

So, how do you write a check?

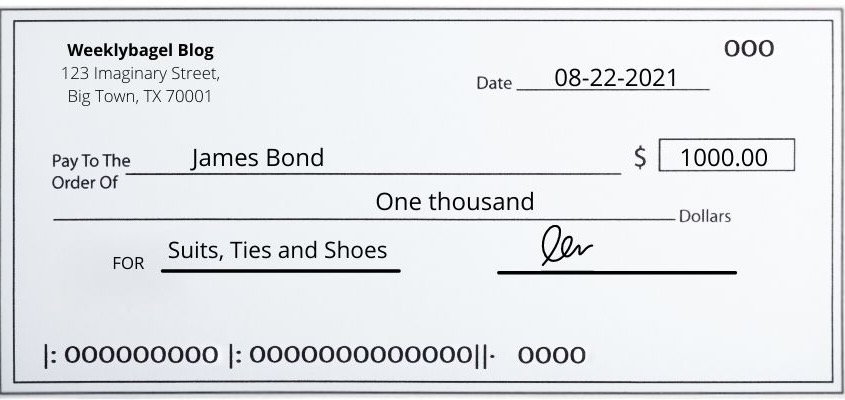

Below are the best practices to avoid check fraud. As I mentioned earlier, your bank can charge you fees for badly written checks. This is especially in cases, where your check is involved in what the bank calls a check fraud. In a worst case scenario, you can get your check privileges revoked. With that said, here is a sample of what to write on a check.

The above is how you should write your check each time. Date, the payee’s name, numerical amount, amount in words, reason for making out check and signature should be filled. You can substitute my details above with yours. Always remember to sign your check on the signature area. It is important, since your payee will not be able to cash an unsigned check.

Additionally, be aware of the way you write your numerical amount. Always use the legal amount format of your country. For example: a check amount in number for one thousand dollars is written as $1000.00, not $1.000.00 as some other countries do. Also, it can be written as $1,000. Either way, these two are acceptable ways to write a check numerical amount in the United States.

How To Write To A Check Numbers In Words

Where some people screw up check writing, is writing the legal amount in words. It is a little tricky, when the legal amount includes cents. The best practice is to write the amount in dollar in full words, then use “and” to connect cents.

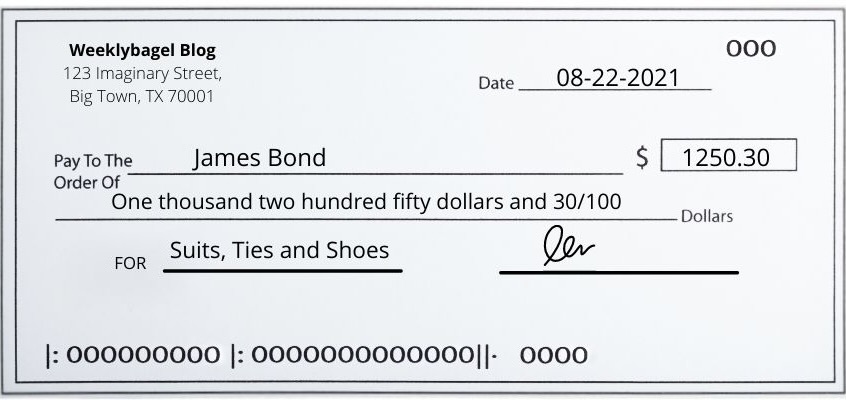

For example, how do you write $1200 on a check?

You can write it as: One thousand two hundred dollars. If it is $1250.30, then you have to use the conjunction “and” to connect the dollars and cents. Write it this way: One thousand two hundred fifty dollars and 30/100 cents. As long as the amount in cent is less than 100 cents, you should always write it as a fraction of 100 cents.

Here is an image to illustrate, my good reader.

As seen from the above check, the word- dollar, is used with the legal amount in words. That is okay. Banks will accept it too. The whole point of writing your check amount in words is to avoid a misunderstanding. And, this clears it.

Finally, this is how to write a check with cents. It is best practice to write any cent in the amount as a fraction of 100. It is easy. Finally, it saves writing space.

What Are the Three Rules For Check Writing?

Writing a check is a responsibility. It is your responsibility to set your check for success. By success, I mean no fraud incident.

To properly write a check, there are three rules you must never forsake. There is a great risk of check fraud, when you forsake them. Hence, pay great attention to these three best practices.

1. Never Write A Check With Erasable Ink

This is a very bad idea, especially checks written for strangers and workers. Do not write a check with erasable ink, because it can be altered. And yes- whoever alters it knows they may go to jail for fraud, but not everyone cares.

Besides, you do not want someone to pull a number on you. It can damage your relationship with your bank. As an adult with a bank account, you need your relationship with your bank to be good. In case of future loans, banks often refer to your banking history with them. A check fraud which results from altered checks may lower your trustworthiness with your bank.

This is why it is best practice to use a permanent ink on your checks. It makes sure your inputs are not altered. I highly recommended using a black pen too.

2. Never Give A Blank Check

Did you ever see that 1994 comedy movie- Blank Check?

It is a lesson to anyone who does not take check writing seriously. When you make a check out to someone, fill it and sign. Never give the check to the person to fill. It is a very bad idea.

Moreover, people can be tempted to take more than you want them to. This includes people you care and trust. In order to decrease check fraud, this is a rule you must always obey. Do not give blank checks to people, unless it is a money order from a bank.

3. Always Sign With the Same Signature

There is a penalty for using different signatures in bank transactions. Firstly, the IRS can come after you for fraud. Hence, a good practice to use your original signature in your financial transactions. In this case, writing a check.

Can You Write A Check To Yourself?

You can write a check to yourself to get cash. It is the same process as making out one to someone. However, the only difference is the payee will have your name instead of another name on it. As usual, you can cash this check with your bank. It may take one to three business days to clear like any other checks.

Well, these are what you need to know about writing a check.

In conclusion of this post, I would like to remind you check writing is a huge responsibility. This is because it can cause you financial problems, when the rules are not followed. By financial problems here, I refer to penalties by banks and interested financial parties. So, be aware please.

How To Save On Electric Bills In All Seasons

How To Save On Electric Bills In All Seasons