As an adult, the last thing you want is to get scammed with a certified check. Banks will not take kindly to you depositing a fake check. In fact, you can be penalized for trying to cash one. Hence, the important of verifying a check prior to deposit.

For payment purposes, there are three kinds of checks a person can issue to you for services. There are certified checks, personal checks and cashier’s checks. A cashier’s check is the best out of the three, since the payer’s bank takes money out of the payer’s account before giving him the check. So, there is low risk of a bounce if it is not a fake check.

On the other hand, a personal check is not guaranteed by the payer’s financial institution. In other words, the check can bounce on you, if the payer does not have sufficient funds in his or her account. This is because any amount being paid to you, is deducted from the personal bank account of the issuer.

Usually, a certified check is a type of personal check which carries a bank certified stamp. A certified check is guaranteed by the bank, since the bank withholds the amount of the check until it clears on your side. Also, the certified stamp on the check tells you the bank acknowledges there is enough fund on the payer’s account for the check to go through.

Despite these checks bearing bank symbols, these checks can still be replicated by good scam artists. Or, a payer can knowingly give you a bad personal check. This is why a check has to be verified before you deposit it.

What Does Verifying A Check Mean?

To verify a check is a way of determining whether the check is going to bounce. By bounce here, I refer to a check not getting cashed because whoever paid you did not have sufficient balance. But, this is not the worst of it all.

A check can be faked. Yes, you heard me right. You can get scammed through a check. People can intentionally forge a check and make it out to you during a service. This is especially, when they will not be seeing you any time soon.

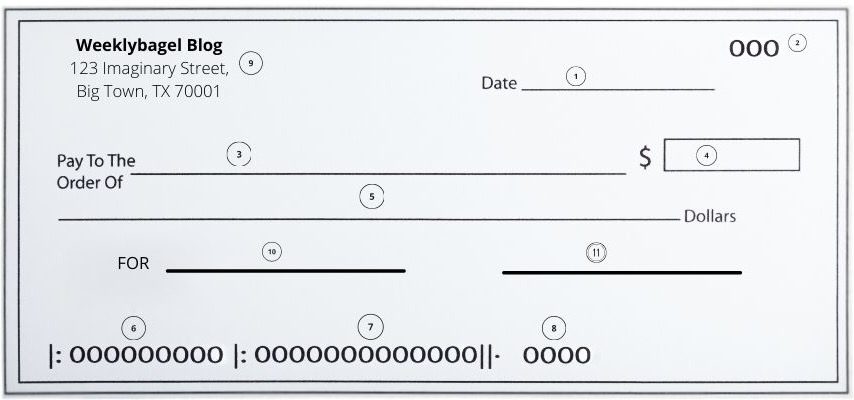

To avoid such a situation, you need to know the universal anatomy of a check. This is to avoid getting a piece of useless paper as a check, because someone says it is. On a previous article, How To Write A Check To Someone: 3 Best Practices, I discussed about the anatomical parts of a check to be aware of. Since you are the one receiving the check, read the article above to ensure it has the required components.

Additionally, banks always use a check verification system to make sure the payer has a valid bank account, sufficient balance and other details. Details like the check is really made to you. In other words, it was not stolen. All these have to be done, before funds are released to you. This is how check verification works.

Do Banks Verify Checks For People?

Yes.

In fact, it is the fastest way to verify a check. You can visit the bank who owns the check to inquire whether the check is valid. It is worthwhile to note a bank cannot disclose the account balance of the payer. However, they can tell you whether the check is valid to cash.

Want to know the best part of it?

Banks can verify a check for free. You can either call a bank, or walk into one. I would advise you to do the latter though. Banks like to make sure you are a real person with their checks, verifying check funds.

Now, do not get me wrong. Some banks will let you call them on the phone for verification of a check. But, most will rather have you come to their location.

With that said, there are a couple of things the payer’s bank may ask from you. These are a form of identification, the check number, the check amount and the name of the payer. So, make sure you take the check and your ID with you.

How Long Does It Take To Verify A Check With A Bank?

When you go to a payer’s bank for verifying funds on a check, it can be done while you are there. If not, your own bank can take two to three business days to verify funds before releasing the funds to you. In other words, the check verification process takes about three business days to clear.

Especially, when your account is in good standing with the bank. But, a history of depositing bad checks can get your account penalized. Therefore, increasing your check verification process by a week or two.

This depends on your bank though. Call them to confirm.

Can You Verify A Check Online?

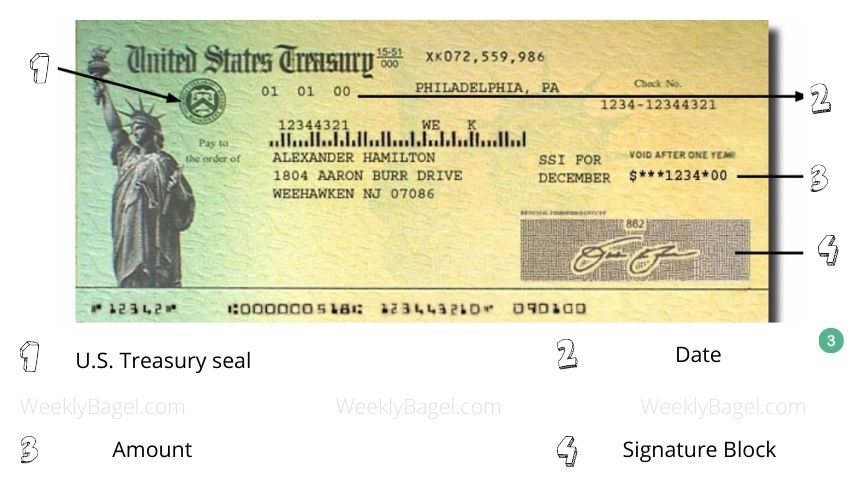

Verifying a check online is not advisable. Unless the check is a Treasurer check, you can verify it at the Bureau Of the Fiscal Service on the US Department Of the Treasury’s online Treasury Check Verification System (TCVS). As long as the check is not more than thirteen months old, you are good.

To avoid confusion, a treasury check is a check issued by the United States Federal Government. A few examples of such a check is child support, stimulus or social security checks. Having explained this check, it is the only one you can verify online on United States Of America federal government website. Any other check has to be at the bank of the issuer.

Beware of websites offering to help you verify a check. I do not want you to be used by people- scammers or not. Only banks and their third-parties can verify check.

How To Verify A Treasurer Check?

Since I mentioned treasurer checks, it is important to tell you how to verify one. This is because of the rampant scam checks, which started during the COVID-19 pandemic. You can read the guide to spotting a fake US treasury check.

Here is what you need to know about a treasurer check.

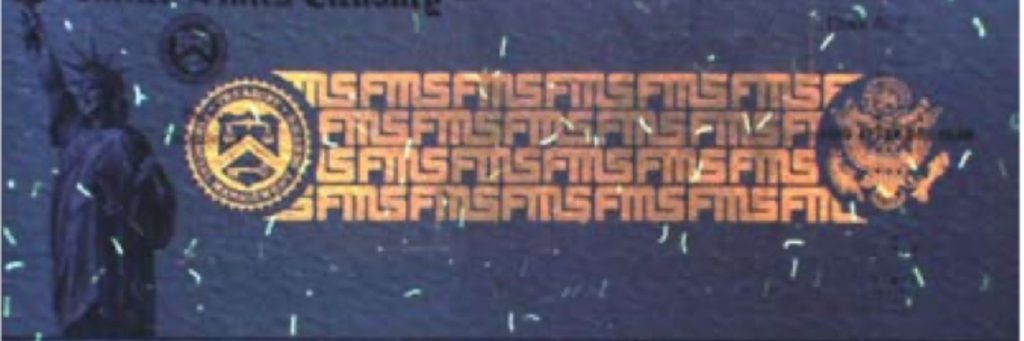

To verify a treasurer’s check, the seal bleeds red whenever moisture touches it. Also, the check is water-marked. When held to a light, you should be able to see “U.S Treasury” written all over it. Additionally, you can see an ultraviolet print which glows whenever you pass the check through blacklight. The glow will reveal four lines of “FMS” with the United States seal on the right side and the FMS seal on the left side of the “FMS” lines.

It looks like the copy below.

The above UV printing cannot be photocopied. If the check is phony, this print will not be the same. It is important to check it out.

If you are not satisfied with your individual examination, you can visit the U.S Treasury website to verify your website. All they require from you is a valid routing number, the check amount and number. Click here to visit it.

How Do You Verify A Cashier’s Check?

Having explained a cashier’s check to you earlier. There is little risk of the check bouncing, since issuer’s bank deducted the check amount from the payer’s account before making out the check. But, verifying a cashier’s check can be tricky. You can get scammed with a cashier’s check, since you may not be familiar with the payer’s bank.

Here is how to tell if a cashier’s check is real or fake.

Besides calling on the bank to confirm, you can look up the bank’s cashier check features. Banks tend to include security and safety features on their cashier’s checks. And, these can be difficult to replicate.

Some good examples of these safety measures are watermarks, ultraviolet print, microprint or other identification features. Moreover, the amount on the check can tip you on its validity. Usually, the cashier’s check may have more than the amount required for such a check.

Besides, it is good to consider the reputation of the payer. If the check is from a reputable payer, then there is nothing to worry about. But, if it is from a person you are not comfortable with, then you need to get additional verification before you deposit such a cashier’s check.

You have seen the movie- Catch Me If You Can, have you not?

This is why it is important to call or visit the issue’s bank to inquire about the check. A good rule of thumb is not to call the number on the check, since it may be a number of the scammer’s associate. After all, these guys are quite good at their jobs.

Well, I have exhausted what I have got to say to you about verifying a check. It will be hard for anyone to fraud you with a fake check now. You know too much.

Biden Cancels Student Debt For Disabled People: How To Get Yours

Biden Cancels Student Debt For Disabled People: How To Get Yours