Mark Kantrowitz, a recognized expert on student financial aid and loan, says he feels Biden will. This is due to concerns, when the president did not include student loan forgiveness on his annual budget and legislation request. Since his political campaign was based on his ambitious American Rescue Plan, not including a student loan forgiveness in his request left many wondering. Hence the question, is Biden going to forgive student loans?

Despite the absence of student debt forgiveness in his annual request, it is still possible. So far, the president has discharged $1.5 billion in student debt under borrower defense. Borrower Defense is a claim for student relief in situations, where you feel your school has misled you. Or even, worse engaged in certain misconducts.

Simply put, it is for students whose schools have broken certain state laws. A notorious example of such a school is ITT Technical Institute. Under borrower defense claim, the student debts of their 18,000 students will get discharged. This is what Biden’s government has been able to do. To see whether you are eligible, click here.

Although Biden has been able to discharge some student debts through this provision, the push to forgive all student loan debt up to $50,000 faces challenges. The White House proclaims this plan as ambitious, but possible on its website. However, I see many challenges in the way of Biden’s student loan forgiveness plan. Here is the most important one.

1. Biden Does Not Have the Legal Power For this Issue

Concerning the issue of student loan debt forgiveness, I saw New York’s senator and the senate majority leader- Chuck Schumer tweets:

Student debt is holding back millions from being able to build the financial resources needed to build their futures. And this is a burden that falls especially hard on Black borrowers. President Biden can #CancelStudentDebt with the stroke of a pen.

Chuck Schumer (Twitter)

Well, it is not that simple. Biden does not have the legal power to wipe off student loans and debts with a stroke of pen. He will need Congress to do it for him, while he either signs or vetoes it. This is how our American federal system works. But, it is worthwhile to remind you he signed the American Rescue Plan on March 11th, which allows a tax-free provision on any student loan forgiveness program. This provision stays in place till year 2025.

Besides, Biden is not really with forgiving debts of up to $50,000 per borrower. On an interview with New York Times on May 20th, he made it clear that he can only go for $10,000 student debt forgiveness. This is despite democrats and progressives pushing for $50,000 debt forgiveness per borrower. Meanwhile, some conservative republicans are strong opponents of any loan forgiveness. The next challenge discusses why.

2. Cost Of the Proposed ALL Student Loan Debt Forgiveness

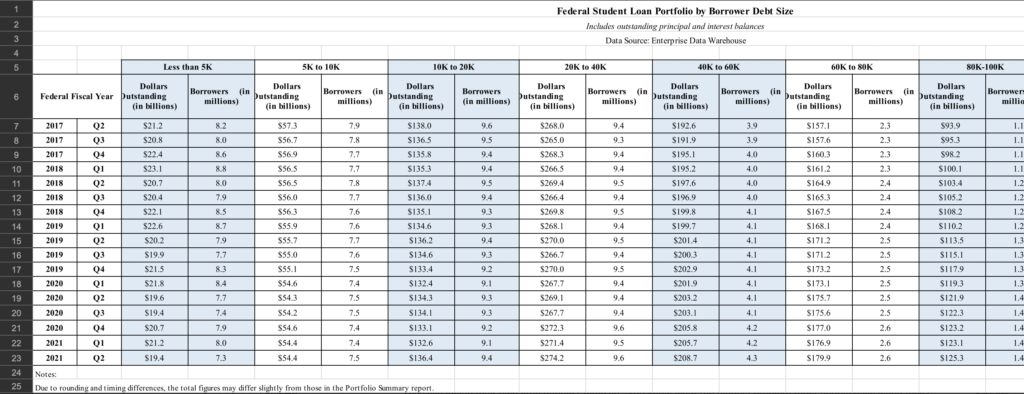

The difficulty in passing this legislative solution to mounting student debt in the COVID-19 era, is the cost for the federal government. As of 2021, the Federal Student Loan Portfolio puts this debt size to be more than $1 trillion. This is across a range of borrowers and the size of amounts borrowed. Below, I took a snippet of the federal student loan portfolio by borrower debt size.

From this data, it can be seen that forgiving each student loan debt will cost around the amount owed. For example, a student loan debt forgiveness for students owing about $5K to $10k will cost the federal government $554.4 billions. This is per the 7.5 million students in that category, as of 2021 second quarter.

As a result, opponents of Biden’s student loan debt forgiveness are strongly against the government spending that much for you. According to them, it will warrant the federal government digging into its financial coffers. Hence, why a lot of them consider this a financial irresponsibility on the part of the federal executive branch. This is why they are making it hard for Biden to forgive student loans.

Is Biden Still Going To Forgive Student Loans?

Despite these challenges, there is still a hope of Congress coming up with a legislative solution favorable to Biden. Currently, the democrats face serious opposition. But, they can be pushed to use a special legislative process called Reconciliation to advance this fiscal legislation. According to Center On Budget and Policy Priorities,

In the Senate, reconciliation bills aren’t subject to filibuster and the scope of amendments is limited, giving this process real advantages for enacting controversial budget and tax measures. This paper addresses some frequently asked questions about reconciliation.

Center On Budget and Policy Priorities- Introduction to Budget “Reconciliation”

Basically, it can be used to enact fiscal policies which are likely to get vetoed. Now, whether the democrats could use this is a matter of time and their degree of desperation. For now, here is an advice from StudentAid.gov:

REMEMBER: Your federal student loans can’t be canceled or forgiven because you didn’t get the education or job you expected or you didn’t complete your education (unless you couldn’t complete your education because your school closed).

StudentAid.gov- Student Loan Repayment

With that said, here are how to go about repaying your student loan since October- the month of student loan repayment, is around the corner.

Current COVID-19 Student Loan Relief Measures

Given the Biden administration is struggling to forgive all student loan debts, there are still some Covid-19 student loan and debt flexibilities in place. These are to help students, since the pandemic affected everyone. Below are some, which have to do with your student loan repayment.

1. Zero Interest Rate On Loans

According to the Federal Student Loan Office,

NOTE: You do not have to pay to get 0% interest or suspended payments for your student loans. Some companies may charge a fee to give you repayment help for federal student loans during the COVID-19 emergency. These companies are not affiliated with or endorsed by the U.S. Department of Education (ED).

StudentAid.gov – Coronavirus and Forbearance Info for Students, Borrowers, and Parents

During the emergency relief period which started on March 2020, interest will not accrue on your student loan until the end of the period. Therefore, payment made during this period goes into your principal. But, this does not mean interest accrued prior to the emergency relief period is wiped off. It is still there.

Furthermore, the Covid-19 student emergency relief will not stay for long unless extended. Currently, it is running until at least Sept 30th 2021. If you are working, it will be a good idea to start paying off some of your principal. To learn more about the loans which qualify for zero interest, click here.

To take advantage of this provision for loan repayment, I will advice you to go for Income-Driven Repayment plan. IDR is one of the best ways of repaying your student debt, since it uses your income and family size to make repayment easy for you. Sometimes, you can get zero interest on your loan repayment; it depends on your income. This is after the Covid-19 student emergency relief period- the zero interest on loan package. The best part of it is that it includes most federal student loans.

Finally, click here to see whether you are eligible for it. It is on the federal student aid office website. If you have any question, reach out to your loan provider. Be aware of other people trying to get you to pay them for solutions. There has been a lot of student loan repayment scam calls lately.

2. The Suspension Of Student Loan Repayment

Currently, student loan repayment is suspended through at least Sept 30th, 2021. Sincerely, I recommend you start strategizing for repayment now. For the unemployed, you can start looking for means to defer your loan repayment. In fact, there is unemployment deferment program. You can use it.

To check eligibility, download their form here. Then, mail it out to them. The form will expire on August 31st, 2021. So, I will advice to apply right now.

I nearly forgot to mention, dear reader. This unemployment deferment is for these loans: William D. Ford Federal (Direct Loan) program, The Federal Family Education Loan (FFEL) Program and Federal Perkins Loan (Perkins Loan) program. These are listed on the form. If you have questions relating to this form or unemployment deferment, please talk to your loan provider.

3. Apply For Public Service Loan Forgiveness (PLSF)

If you are a graduate with student debt working in a public sector, you can get your student debt forgiven. There are some certain requirements though. Firstly, you have to be working for United States government tiers (Federal, State, Local or Tribal). According to Federal StudentAid Office, it is not about the job. But, who you are working for.

What about the US military?

Yes- members of the armed forces in the United States are eligible to apply too. Besides them, employers of non-profit organizations are eligible. Here are who is not:

- For-profit organizations

- Political organizations (partisan)

- Unions, particularly labor unions

In addition, there are other requirements for this type of loan forgiveness. One of them is you have to be considered full-time for whom you are working with. There is a 30 hour per week minimum for this consideration. Here are more information and application form for this kind of student loan forgiveness.

Well, this sums today’s post for me. I hope I have been able to help you in your journey towards taking care of your student loans. Hopefully, Biden gives our students a break here by forgiving all student loans. If there is something I believe, it is that student loan forgiveness act will help many parents save money for their kids’ college tuitions. It will definitely save the next generation a lot of headache associated with accruing student loan debt. Don’t you think?

Resources:

- Federal Student Aid, studentaid.gov/borrower-defense/.

- Federal Student Aid, studentaid.gov/manage-loans/forgiveness-cancellation/public-service#eligible-loans.

- Mark Kantrowitz, www.kantrowitz.com/kantrowitz/mark.html.

- “President Biden Announces American Rescue Plan.” The White House, The United States Government, 12 Mar. 2021, www.whitehouse.gov/briefing-room/legislation/2021/01/20/president-biden-announces-american-rescue-plan/.

Is Cryptocurrency A Good Investment For Millennials?

Is Cryptocurrency A Good Investment For Millennials?